Today’s blog was prompted by a postcard from the United Cancer Research Society which was first recognized by the IRS as a non-profit in 1974. It is the second in a series of blogs reporting on nonprofits that use such cards to solicit donations of clothing and household goods to be picked up by their driver at a later date.

Without all the necessary expertise and background information, evaluating UCRS is a bit complicated since they have their own thrift store in Redlands, CA; also solicit donations in the form of cash and annuities; and also contract with commercial fundraisers who solicit donations of salvageable goods on their behalf. On the other hand, there’s reams of information available online that help confirm that it is far wiser to donate to LOCAL NON-PROFITS whom you can trust.

As this UCRS mailer and pick up service is likely coordinated by a commercial fundraiser, we’ll focus initially on their role. A California Attorney General report on Commercial Fundraising for the 2012 calendar year identified KKA Enterprises as a Fundraiser for UCRS. That year, KKA reported $3.78 million dollars in revenue - of which, UCRS received $115,000 or 3%. In 2012, the United Cancer Research Society’s sole charitable donations were $12,500 to the Childhood Cancer Foundation of Southern California and $5,000 to the Leukemia and Lymphoma Society. That’s 0.0046% of the original $3.78 million.

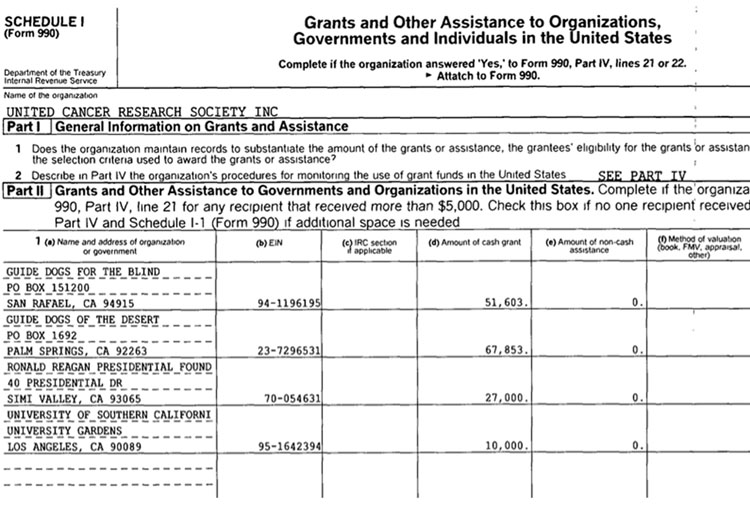

In previous years, UCRS was a far larger operation. On their 2009 Form 990, they reported $1.45 million in non-cash donations (presumably, salvageable property) and a total of $6.77 million in such donations over the previous five years. For 2009, they claimed $168,456 in grants “to organizations conducting cancer research and developing cancer treatments and other charitable organizations”. However, as shown in the excerpt posted below, none of the top four grantees were cancer related and one of those for $27,000 was to the Ronald Reagan Presidential Foundation.

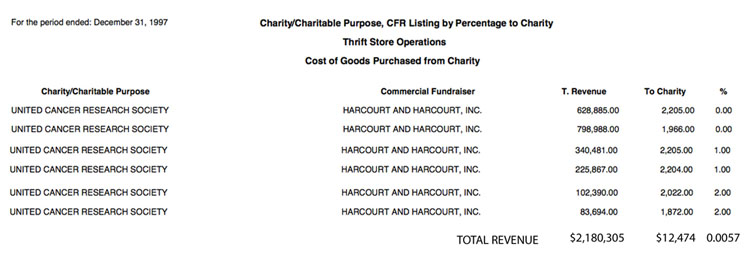

An even earlier report on 1997 fundraising solicitations indicated that UCRS was then represented by Harcourt and Harcourt which earned $2.18 million - of which UCRS received just over $12,000.

As an aside, Harcourt and Harcourt is currently based in Coachella, CA at an address they share with the Oasis Thrift Shop that advertises (along with a branch in Beaumont) that “proceeds benefit Fight Cancer Now”.

Not coincidentally, Fight Cancer Now also shares the 6th Street address in Coachella. For 2012, they reported $2,286 in revenue and $3,227 in expenses to the IRS.

REFERENCES:

990 Forms for UCRS via Propublica

For 2012, Nationwide Report on Commercial Fundraisers

For 1997, California Report on Commercial Fundraisers

990 Forms for UCRS via Propublica

For 2012, Nationwide Report on Commercial Fundraisers

For 1997, California Report on Commercial Fundraisers

RSS Feed

RSS Feed